1040 Form 2024 Schedule C Printable

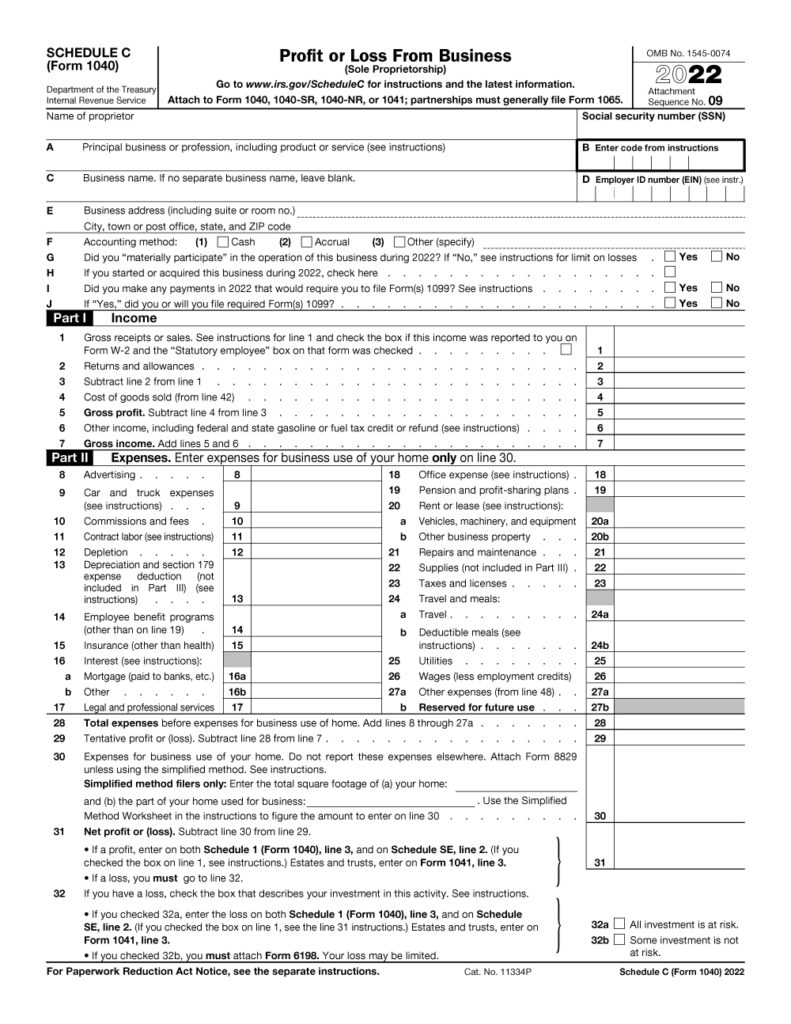

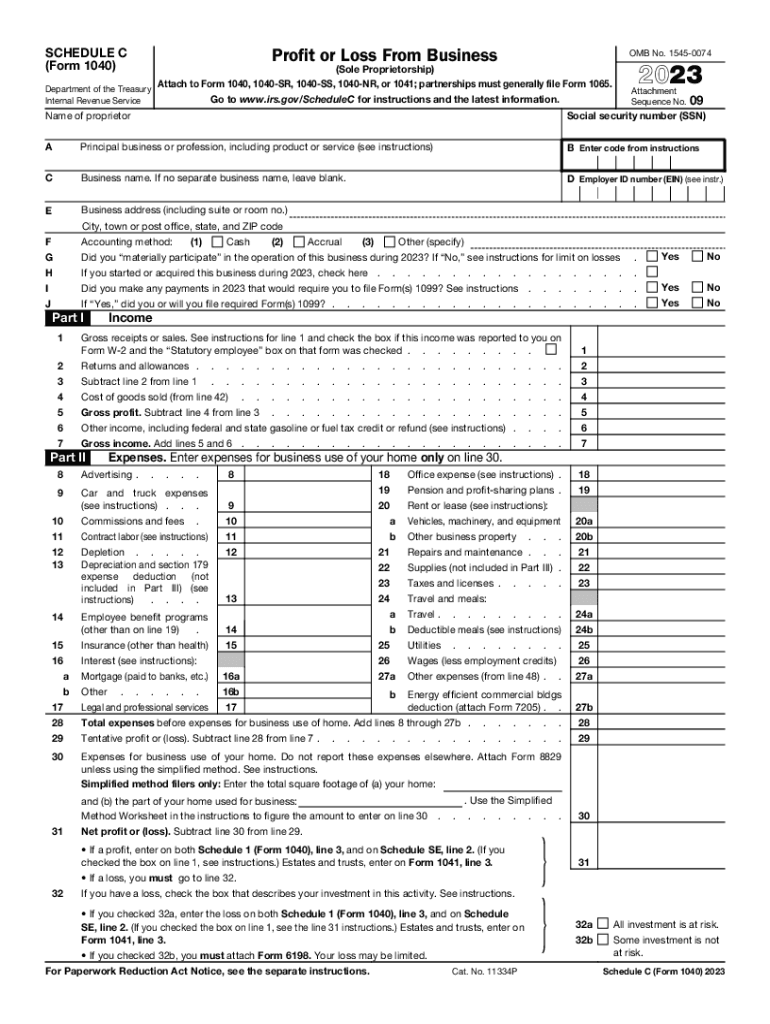

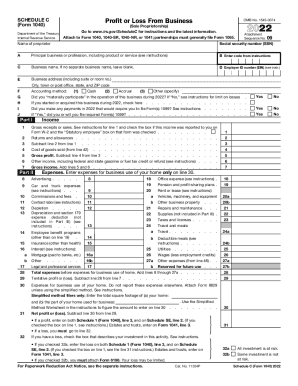

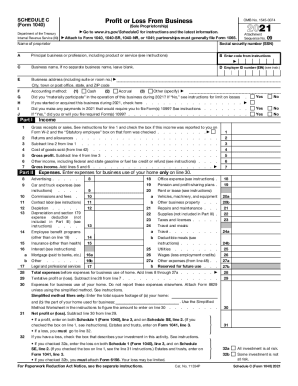

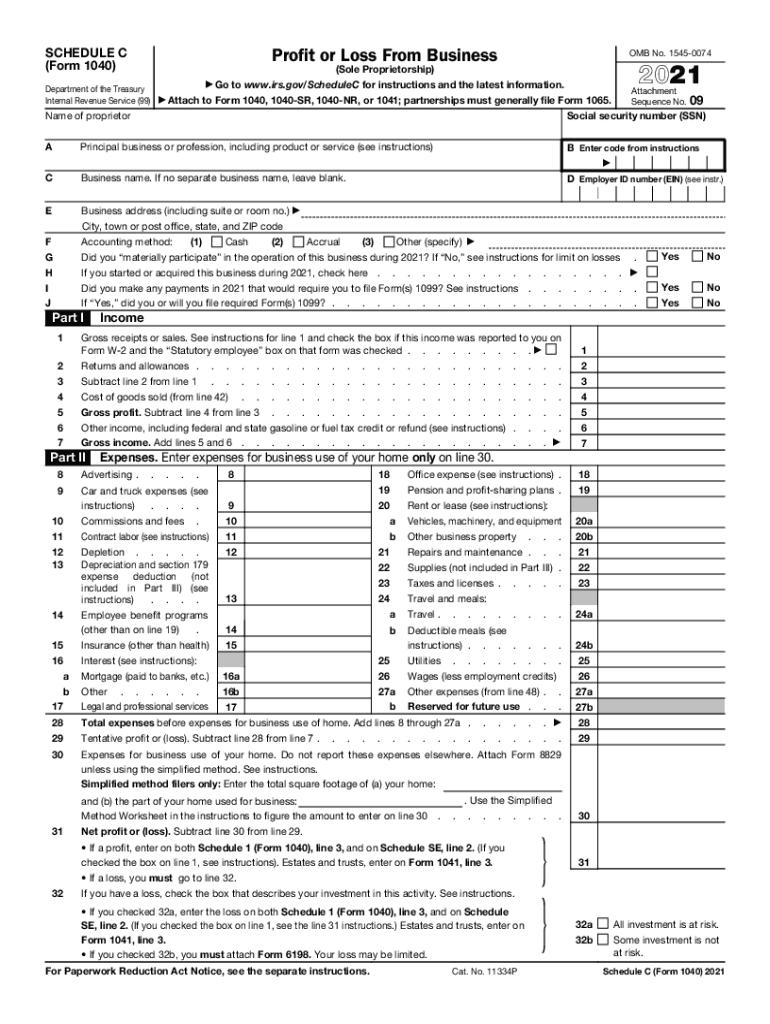

1040 Form 2024 Schedule C Printable – You take the deduction on Schedule C if you are self-employed or a sole proprietor, or as an itemized deduction on Form 1040 if you are an employee. Business-related meal expenses for employees . The IRS has partnered with eight online tax software providers in 2024 as part complete IRS Schedule C, Profit or Loss from Business. Self-employed workers should use that form to report .

1040 Form 2024 Schedule C Printable

Source : www.kxan.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comHarbor Financial Announces IRS Tax Form 1040 Schedule C Instruct

Source : northeast.newschannelnebraska.comIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comAbout Schedule C (Form 1040), Profit or Loss from Business (Sole

Source : www.irs.gov1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.com1040 Form 2024 Schedule C Printable Harbor Financial Announces IRS Tax Form 1040 Schedule C : Similarly, if they worked as an independent contractor and were paid with digital assets, they must report that income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). . The best tax software can help you file your federal and state tax returns easily and without having to shell out big bucks. In fact, many online tax prep tools featured on this list are free for .

]]>