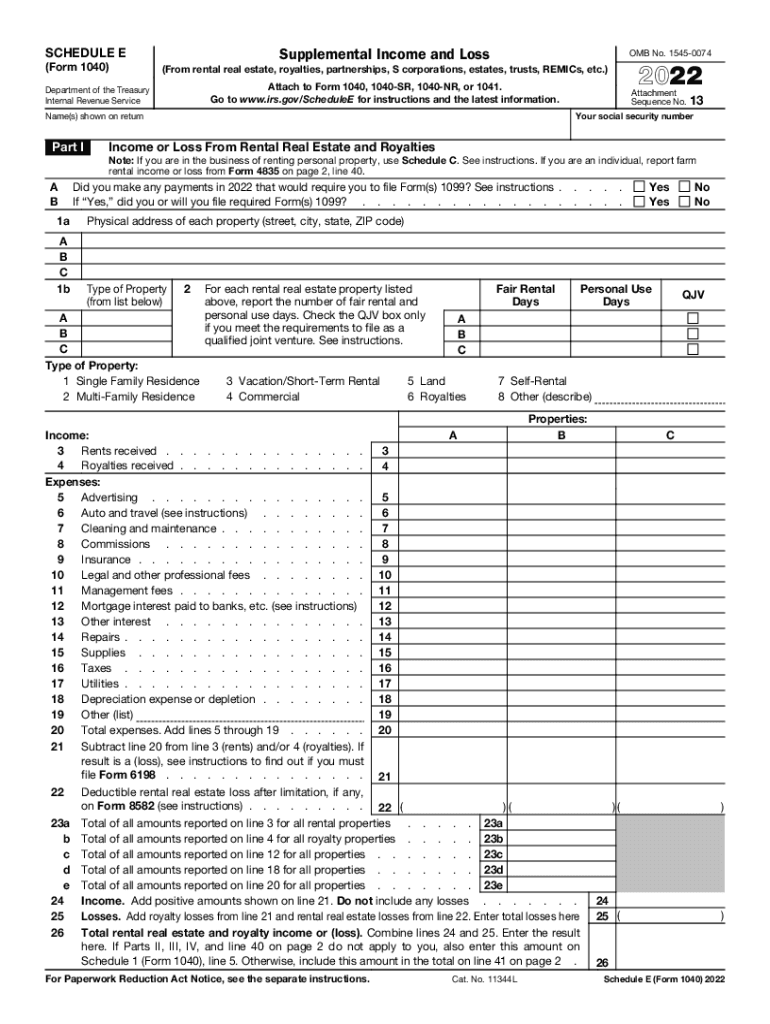

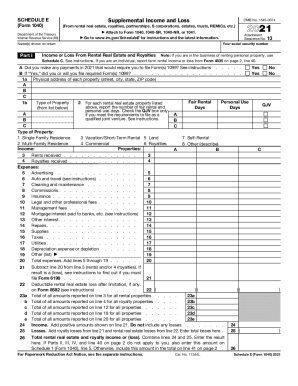

2024 Schedule E Form 1040

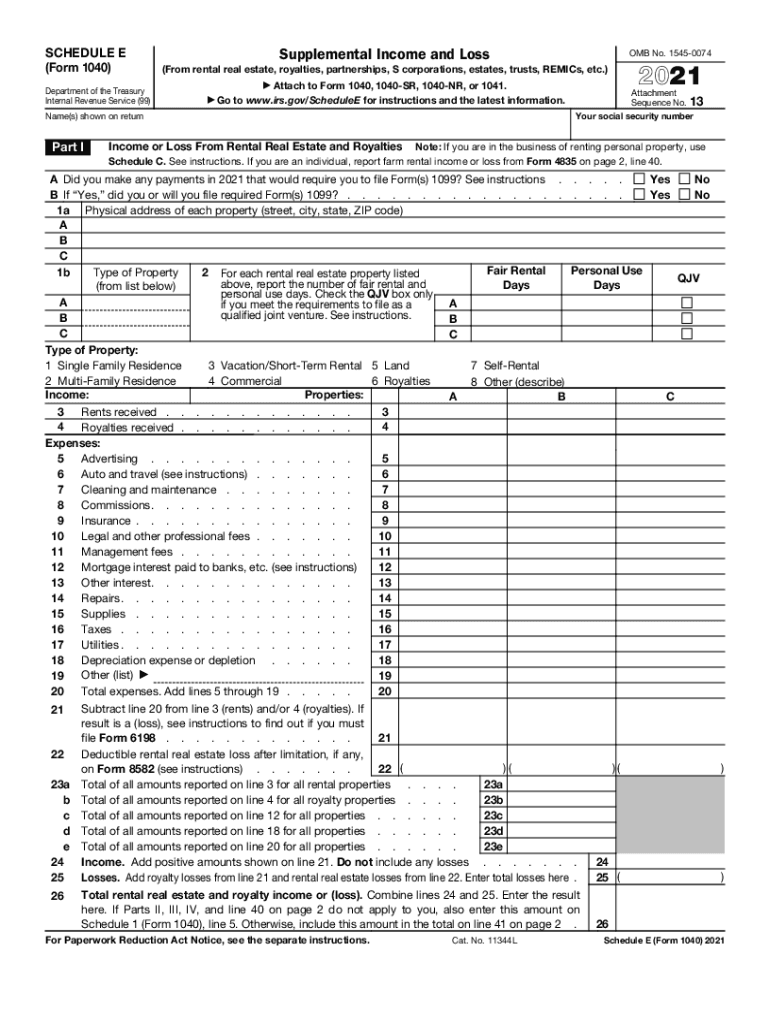

2024 Schedule E Form 1040 – For S Corporations filing Schedule E and Schedule C owners, the deduction takes place on the 1040 tax form. For C corporations, regardless of size of the corporation, the premiums for the employee . The Internal Revenue Service requires all income from a rental property to be reported on Form 1040 Schedule E. The same form also allows you to deduct certain expenses related to the rental from .

2024 Schedule E Form 1040

Source : www.turbotenant.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comTax form schedule e: Fill out & sign online | DocHub

Source : www.dochub.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comIRS Schedule E (1040 form) | pdfFiller

Source : www.pdffiller.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule e: Fill out & sign online | DocHub

Source : www.dochub.com2024 Schedule E Form 1040 Mastering Schedule E: Tax Filing for Landlords Explained: Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. . Partnership 2 or more Owners Schedule K-1 for each partner on Form 1065 and Schedule E on Form 1040 LLC Any; legally separate entities Members Schedule K-1 for each partner on Form 1065 and Schedule E .

]]>